Lets Talk Council Tax

The only real choice with council tax is the right you have to choose where you live and the property you live in that sets the band for the areas council tax you receive.

We pay council tax every year and it’s an unavoidable cost for most tenants and homeowners.

Many receive the envelope through the door once a year and the rest happens in cyberspace as the computers move automatically money from our accounts to the councils bank account as a monthly direct debit that shows on our statant as a single monthly no so small amount but we don't think about why we are paying what we are each month to the council.

We get the yearly bill that contains a breakdown based on our council tax band and that’s it no right to really contest or object it’s a tax that we have little choice but to pay as part of living in the UK.

At face value the council tax bill and the property bands can be quite confusing.

But it's not as perplexing as you might think to get to the bottom of what you’re paying to who and why you’re paying the amount.

So, the first question just what is council tax?

Council tax is a tax enforced by local authorities and applied to homeowners and residential property renters and is a charge most people have to pay on a monthly basis as we have already established.

It’s different to other household costs, such as home insurance or energy bills, as with those you choose who provides the service and how much you pay and for some you can choose not to pay and not get the services as a choice. But your council tax bill does not have a choice when it lands through the letter box.

The only real choice with council tax is the right you have to choose where you live and the property you live in that sets the band for the areas council tax you receive.

Beyond that the choice is out of the hand of most who reive the council tax bill as the amounts that make up the yearly bill are set by councils and police force to fund the services they deliver in your area.

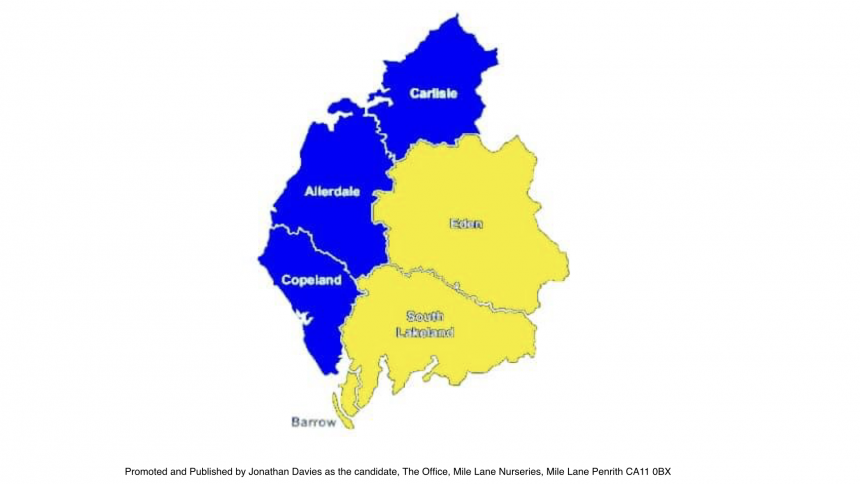

The number of amounts that make up your council tax vary depending on were you live in the UK.

The different councils that cover your property each have an amount for delivery of services this combines with for example the county council, district council, town or parish council, Police force and often social care charge as well.

The local district council is the council tax setting authority the others are precepts added to the amount set by the district council and combine to make a total yearly amount for the area.

This is calculated by the council tax bands of property in the area, which are based on the value of your property at specific times.

The bands split the total area amount into household council tax amounts per property band for the local area.

These can vary across a district from parish area to parish area depending on the precept of the parish so if you live in a village, you will not pay the same as the next village or town depending on the amount your parish council sets as its precept for local services.

Now council tax just covers domestic property and not all of what you may think pays council tax.

Some properties for example holiday homes, guest houses pay business rates these have no direct link to council tax and for example your parish council gets £0 precept from business rates.

So, if a parish council kept its precept frozen year after year you could still have to pay more as a council taxpayer of for example 1,2,3 or more houses become holiday cottages and switch to Business rates.

The parish area would have less homes to precept against and the loss for the same amount of money would be split between the properties that do pay council tax.

This can in some communities have a big impact on the council tax and the parish council’s ability to deliver services as they try to balance the budget with a sustainable precept to avoid increases to the parish precept.

Often County district and police don’t appear as community minded in keeping the amounts low or frozen and so the overall council tax bill that lands through the door increases.

Let’s look at some real-world examples of how the council tax bill is made up.

In Penrith an average Band D property will for 2021-2022 council tax year have faced a yearly bill of £2,054.04 With a precept from the parish council of £83.09 included in that amount.

This gives the parish council a total precept amount of £450,069 for the year 2020-2021

A few miles down the road still in the Eden district in the village of Clifton with its own parish council a band D property will £2,012.75 with a precept from the parish council of £41.08

This gives the parish council a total precept amount of £11,500 for the year 2020-2021

Some big differences in the total precept amounts and the actual precept amount per band for the parish councils.

But what about the rest of the council tax that averages out at around £1970.95 a Band D property pays to the County Council, District council, Police and a social care charge levied by the county council.

This breaks down to

Cumbria County Council: £ 1,385.28

Cumbria Police: £ 256.68

Eden Council: £190.75

Adult Social Care: £

So, who does what with the money we pay each month to cover the yearly bill.

The basic idea is that the council tax you pay goes back into supporting your local community although this will mean the depending on the breakdown list supporting the community county wide, district wide or parish wide areas with the various amounts per authority and county wide for police and the social care precepts.

For example, Cumbria County council uses some of the £1,385.28 you pay via your council tax to fund Fire and Rescue Services, Library services and Infrastructure as a few examples.

Eden as the district council in the above example to fund Bin collections, Playparks, economic projects, planning services as a few core functions.

Parish councils this can vary but some streetlighting, playparks, community spaces, allotments, as a few examples.

How is council tax calculated?

Council tax splits into bands, based on your property and don’t change unless there is a revaluation based on changes to the property or a national revaluation is carried out.

For properties in England, council tax bands use the property’s value on 1 April 1991:

A Up to £40,000

B £40,001 - £52,000

C £52,001 - £68,000

D £68,001 - £88,000

E £88,001 - £120,000

F £120,001 - £160,000

G £160,001 - £320,000

H £320,001 +

Band D us used as the point that council tax is worked out for the other bands, and it decreases or increased per band from Band D.

Using the Penrith and Clifton examples from above this means in 2021-2022 the bands each paid

Band A B C D E F G H

Penrith 1,369.35 | 1,597.60 | 1,825.81 | 2,054.04 | 2,510.48 | 2,966.95 | 3,423.39 | 4,108.08

Clifton 1,341.83 | 1,565.48 | 1,789.11 | 2,012.75 | 2,460.02 | 2,907.31 | 3,354.58 | 4,025.50

Within each council and precepting authority they have legal statutory duties and functions and require staff to act as officers and provide support services to enable the authority to function legally and delver the services and functions.

In Cumbria County Council and the district councils the councillors also get paid an allowance as councillors.

Using the Penrith and Eden examples.

The county councillors get £8,744 per year and there are 9 covering Eden

And the district councillors get £3,864 with 38 covering Eden

With the leader getting an additional £11,592 per year.

Some get additional depending on special duties and portfolios they have plus expenses can be claimed for various things.

Parish councillors normally do this without any allowance payments as volunteers acting to supporting the community through the role as councillors. The number of councillors per parish council varies depending on the size of the council area and the numbers set in governance reviews carried out by the district councils.

So that’s how the council tax is set and who gets what from the amount you pay each year via the monthly amounts that automatically leave your bank account each month.

Does everyone pay the same in the local area based on bands then?

The simple answer is yes and no.

Yes, each property is set the council tax based on the property band and every property in each parish area is the same for each band.

No because there are some discount and exemptions based on personal circumstances of those in the property such as unemployed persons, care leavers.

Council tax is bills assuming that a property has two adults living in the property. So single occupant properties get a £25% discount of the council tax.

And uninhabited properties get 100% discounts applied to them so the empty house down the road is costing you more on your council tax for a period that its exempt.

This all impacts on the amount that is paid by other council taxpayers and ultimately the amounts the various authorities have to spend serving the communities they cover.

So how did we get to council tax?

Before council tax we had something called the community charge also known as “Poll Tax” that was billed to each individual person over 16 and they were responsible for paying.

The amount was set per person at a fixed amount but there was a reduction for those with lower household income.

Each person paid via the tax used to fund local government for the services provided in their community.

The system was very unpopular since many felt it shifted the tax burden from the rich to the poor in communities, as it was based on the number of occupants living in a house, rather than on the estimated market value of the house.

Many tax rates set by local councils proved to be much higher than earlier predictions. This led to large scale protests and unrest in the 1990’s and contributed to the change of PM at the time and the replacement of the Community Charge with the Council Tax based on property value we have today that was closer in the rates system that was in operation before the Community charge “Poll Tax” replaced it.

Is Council Tax any better that the community charge or worse and what option are there to replace it?

To be continued....